Finding the funding that's right for you

APPLY TODAY for personal Funding & Credit Consultation

Choose Funding That Fits Your Needs

Get Offers Without Hurting Your Credit

500+ Credit Scores OK, as fast as 24 Hr Funding.

See some of the lowest rates available, transparent & clear repayment terms. View our lending partners below.

CLICK BELOW TO WATCH FIRST!

A Message from ATHENA FinancE

OUR FASTEST FUNDING - No Collateral Needed!

Up to $2M with Bank Breezy

No Hard Credit Pull

No Hard Credit Pull

No Hard Credit Pull

How Rok helps start-ups & high-risk businesses

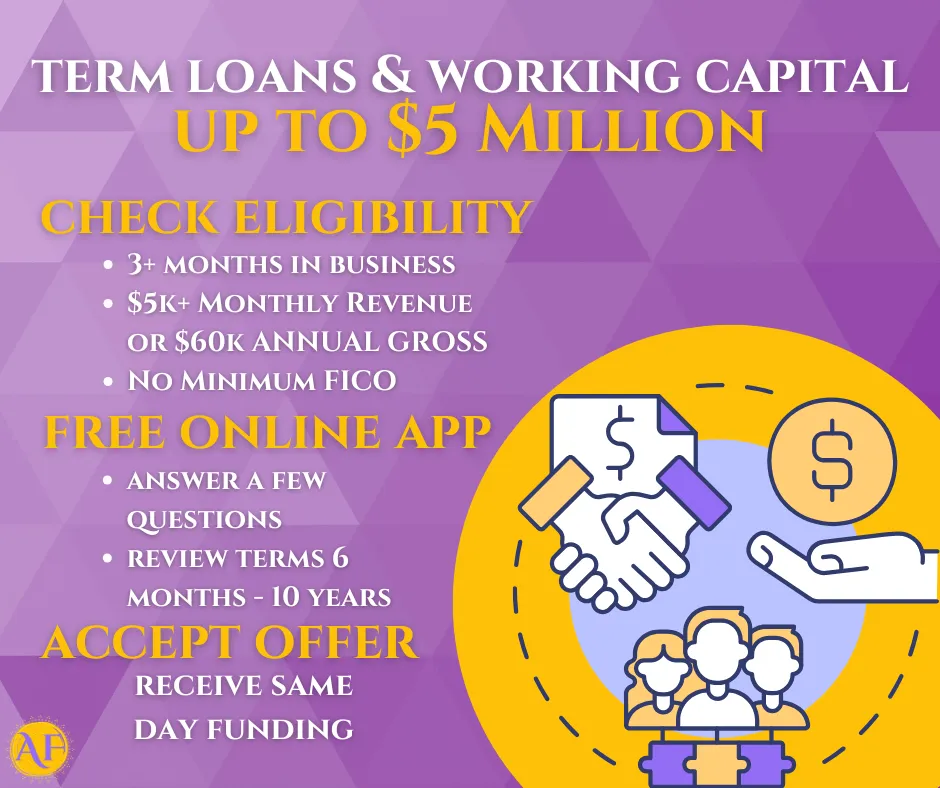

Term Loans & Working Capital

Here's the deal: you can use these funds to take your business to the next level, whether that's expansion or a big purchase. You'll get all the funds upfront, at superb rates, and you can always ask for more if you need it.

Lines Of Credit

Need to keep your cash flow smooth or stock up on inventory? Maybe a surprise expense popped up? No worries. That's where a revolving line of credit comes in handy. It's your go-to for cash when you need it. Simple as that.

SBA Loans

Need a cash boost for your business? Athena has you covered with speedy SBA loans, all at a prime rate.

Just breeze through our hassle-free application process and you'll have your funding in 30 - 45 days, tops!

Equipment Financing

Get your business the gear it needs, however you want – either through leasing or financing.

Enjoy the advantage of upfront funds, competitive rates, and more room for your working capital to breathe.

Commercial Real Estate

No matter if you're considering an office building, a retail location, a warehouse, an industrial property, a multi-family unit, or even just some undeveloped land, we are here to assist you. Are you prepared to finance your next big project? Let's get started!

INTRODUCING NBA THE BEST SUBORDINATED LENDER

Up To $10M For Select Small & Corporate Businesses

Simplified Funding Requirements:

6+ Months Time in Business

No Minimum FICO Score

No Collateral Necessary

Bankruptcies, Tax Liens, Judgments OK

$10-$100 Million

With Collateral

Frequently Asked Questions

when will I receive my funds?

The time it takes to receive funding can vary depending on the lender and the specifics of each application, but generally, funds from a business cash advance can be available quite quickly. Many providers aim to deliver funds within 24 to 48 hours after an application has been approved.

Does revenue based funding affect my credit?

Typically, receiving a funding advance does not directly impact your credit score because providers usually do not require a hard credit check that would appear on your credit report.

How much does revenue based funding cost/what are the rates?

With BankBreezy: The cost of a cash advance is based on a special rate called a 'factor rate,' which typically ranges from 1.18 to 1.55. This rate isn’t like a regular loan's interest rate. Instead, it multiplies your advance amount to figure out your total repayment.

For example, if your business gets $30,000, you might end up paying back anywhere from $35,400 to $46,500.

The rate you get can vary based on how well your business is doing. Also, some cash advances might include an extra charge called an 'origination fee,' which can be from 0-5% of the advance amount.

What are the minimum requirements?

3+Months in Business.

$5,000 in Monthly Revenue.

500+ Fico Credit Score

US Business Bank Account

No more that 3 Nonsufficient funds in 12months.

how will i know i have been approved?

Your dedicated funding specialist will Contact you, and share all the funding options you have been approved for. They then will work with you to explore the best funding option specific for your business. You will get the best solution tailored to your specific needs.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog